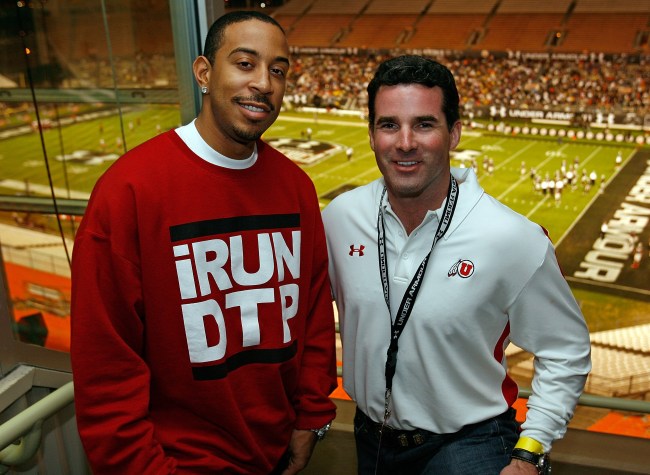

ORLANDO, FL - JANUARY 04: Under Armour founder and president Kevin Plank along with Ludacris pose for a photo at the All America Under Armour Football Game at the Florida Citrus Bowl on January 4, 2009 in Orlando, Florida. (Photo by J. Meric/Getty Images)

Editor’s Note: Welcome to a daily column we run here at BroBible breaking down the day’s biggest stories in sports finance with commentary from the equities analyst and sports fanatic perspectives. It comes to us via our friends at JohnWallStreet, publisher of a free e-mail newsletter focused on sports related public equities and their subsidiaries. You can sign up here.

Under Armour Investors Concerned Plank No Longer Focused on Company

Under Armour (UAA) investors have expressed concerns that CEO Kevin Plank is focused on Plank Industries, his private investment firm, and not on the struggling athletic apparel manufacturer. While “2017 sucked” (Kevin’s words, not mine) for UAA shareholders, Plank Industries (which includes a horse breeding and racing operation) opened a boutique hotel, a whiskey distillery and raised $233 million for a real estate venture in Baltimore. In June, UAA hired Patrik Frisk (former ALDO Group CEO) as President and COO. Frisk has since taken on a more public leadership role, speaking on the October earnings call; offering further evidence to those that believe UAA is no longer Plank’s top priority. Plank insists his “job is running Under Armour, period”; with Plank Industries’ Chief Executive Tom Geddes saying that Plank only reviews his outside investments on a quarterly basis.

Howie Long-Short: In 2017, UAA posted net losses in consecutive quarters, a quarterly sales decline (for the 1st time since going public) and laid off 300+ employees (and a handful of C-level executives) as the stock declined 45.7% YTD; so it’s understandable shareholders are looking to assign blame. For comparison purposes, NKE who had its own set of struggles in ‘17 is up 24% YTD (ADDYY is +13.2%). Regardless of Plank’s involvement, the company is in good hands with Patrick Frisk. Frisk has 30+ years of experience in apparel and retail, having led VF Corp. (VFC) brands The North Face and Timberland before joining Aldo Group.

Fan Marino: Under Armour has agreed to a 10-year deal with Major League Baseball that will make the brand the league’s official uniform supplier beginning with the 2020 season. UAA will be the exclusive provider of all on-field uniform components including jerseys, base layers, outerwear and training apparel. While it’s the company’s first professional uniform deal, they’ve been partners with MLB since 2000; initially as a base-layer supplier (2000) and then becoming a footwear partner (2011).

Adidas Takes Macro View, Competing with Netflix for Share of Wallet

Adidas Global Creative Director Paul Gaudio believes the company isn’t just competing with rival footwear and apparel manufacturers (i.e. NKE, UAA, PMMAF etc.), but with anyone “competing for share of wallet.” Gaudio’s premise assumes that consumers have a fixed budget for recreational purchases and weigh the value of a product not just against its immediate competitors, but against all other products under consideration prior to purchase. ADDYY isn’t the first company outside television and film to be threatened by the blue-chip company; in 2016 Darden (DRI) CEO Gene Lee said the restaurant industry was competing with what he calls today’s “new necessities” (including: smart phones and NFLX) for discretionary dollars. ADDYY reported a Q3 ’17 sales increase of 9% YOY (to $6.6 billion) and profit that increased 30% YOY (to $610 million).

Howie Long-Short: While I admire Mr. Gaudio’s macro view on consumer spending, U.S. consumer confidence remains near a 17 year high. Consumer confidence measures feelings about current and future economic conditions, with an optimistic consumer purchasing more goods and services. If consumer confidence remains high, NFLX isn’t a threat to ADDYY; however, if consumers begin to pull back the reigns on spending (should the economy falter) it’s reasonable to think they will begin asking if that new pair of NMDs is worth forgoing 12 months of binge watching.

Fan Marino: Kanye West got Kim Kardashian a portfolio of blue-chip stocks including; Disney (DIS), Apple (AAPL), Amazon (AMZN), Adidas (ADDYY) and Netflix (NFLX) for Christmas! The portfolio included; 920 shares of DIS (valued at +/-$98,500) and 955 shares of ADDYY (valued at +/- $96,500). That sure beats the luggage I got for Hanukkah as a 16-year-old. Thanks dad (eye roll).

Enjoying the sports finance report? Sign-up for our free daily newsletter

Drew Brees, Von Miller Participate in $4 Million Fanchest Seed Round, Company Sells Team Themed Gift Boxes

Fanchest has closed on $4 million ($5.4 million total) in seed funding; capital the company will use to expand (25 more teams) its team themed gift box business and to increase customer repurchase rates. Each mystery chest (starting at $59) contains officially-licensed team apparel and other fan collectibles (valued at $80), plus a “golden ticket” giving the recipient a chance to win valuable prizes (like signed memorabilia or game tickets). Youth and baby versions are available, in addition to a premium offering that guarantees a player autograph. Drew Brees, Von Miller and DRL CEO Nick Horbaczewski participated in the investment round.

Howie Long-Short: In addition to the individual investors named, GoAhead Ventures (and Connected VC) participated in the seed round. GoAhead Ventures’ investment is noteworthy, as 2 recent Stanford graduates (both on Forbes’ 2017 30 under 30 list) are managing the $55 million venture capital fund and receiving all of the attention. While those 2 make headlines, it’s their partner TK Mori that brings the experience (and credibility) to this group; he’s 53 years old, has 3 IPOs and 5 M&A exits (from previous investments) under his belt.

Fan Marino: Speaking of autographs, Lou Holtz won 100 games and the ’88 National Title as the Notre Dame HC; but it was the 3 Championships he didn’t win (’89, ’90, ’93) that still stick in his craw. Holtz remains so upset that to this day, he signed an autograph for Steiner Sports with the note “1988 National Champs, Screwed in 89,90+93” inscribed under his name. RESPECT Magazine columnist (and friend of JWS) “Scoop B” Robinson talked to Coach Holtz, and had a chance to ask him about the custom inscription. For those wondering, Steiner Sports no longer offers the Lou Holtz “Screwed” helmet, but you can buy one with the words “Save Jimmy Johnson’s Ass for Me” for $599.99.

Still reading? Make sure to sign-up for our free daily newsletter

What is JohnWallStreet?

JohnWallStreet is not a person or location, but a destination for the educated sports fan.

While we won’t be publishing “hot takes” on LeBron’s relative greatness to Jordan, we will be offering up the most relevant sports related finance news, in easily digestible bites, with commentary from both the equities analyst and sports fanatic perspectives.

We’ll cover publicly traded professional teams & stadiums, television networks, apparel & footwear companies, equipment companies, ticketing companies, content and facilities providers. If it trades on Wall Street, and has a sports angle, it’s in our wheel house.

Howie Long-Short and Fan Marino will be providing their expert opinions on each story. They have slightly different areas of expertise. Fan Marino is a firm believer that the SEC is the premier football conference. Howie Long-Short knows it as the Securities & Exchange Commission. Fan Marino lives and dies with the college selection of 5 star, blue chip recruits. Howie Long-Short spends his days analyzing blue chip stocks. Howie Long-Short knows that Black Monday occurred on October 19th, 1987. Fan Marino swears it happens every January after Week 17. You get the point.