Pixabay

Every once in a while, I get an email from my bank asking me to stop by and explore my options when it comes to taking out a mortgage, which is kind of laughable when all they have to do is look at my bank account balance to know I’m a lost cause. Like many millennials in a similar position, the concept of owning a home is an absolutely foreign concept to me, but based on my Facebook feed there are plenty of people out there who are able to do it.

I admit I’m not doing myself any favors by deciding to live in New York City, where the best way to make yourself feel inadequate is to stare through the window of a real estate office and look at how much it costs to buy a one-bedroom. However, I’m happy to pay too much for a clichély tiny studio if it means I get to experience the many perks that come with living in one of the biggest cities in the world— and not having to live in the middle of nowhere.

However, if you don’t mind living in a place where a casual chain restaurant with a weekday in its name is one of the hottest spots in town, you’re going to have a much easier time being able to afford a house. If you’re on a budget but still want to buy, Money examined the data to see which states are the cheapest places to buy a home in— and which places you probably can’t afford to live in.

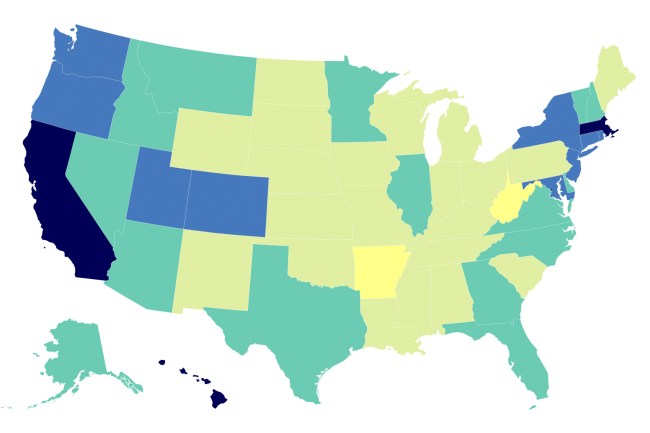

Here’s the map, with the lightest colors coming in at the lowest end and the darkest maxing out the salary cap.

Money

While the data is skewed a bit in states that are home to the country’s major cities and/or a sizeable population of rich people, the map still paints a pretty accurate picture of what you can expect if you decide to stray away from either coast. If you’re looking for a true bargain, then West Virginia is your best bet followed closely by Arkansas (Hawaii and Massachusetts are strictly off limits).

Here are the places to get the best bang for your buck based on the salary you’d need to buy a house in each state.

West Virginia: 35,860

- Kansas: $38,241

- Arkansas: $39,857

- Mississippi: $41,963

- Kentucky: $43,071

- Oklahoma: $43,303

- Missouri: $44,283

- Indiana: $44,998

- Ohio: $45,071

- Alabama: $46,142

- Louisiana: $47,932

At the other end, there’s:

- Washington, D.C: $136,613

- Hawaii: $135,119

- California: $123,764

- Massachusetts: $111,453

- New York: $97,682

- New Jersey: $95,973

- Washinton: $92, 591

- Colorado: $93,679

- Oregon: $92,032

- Connecticut: $85,414

However, before you decide to uproot your life and take your talents to rural America, there’s one other stat you should probably take into consideration: 70% of millennials regret buying their homes.

You’ve been warned.