If you’ve ever tried to get a legitimate insurance claim paid out, you know it can feel like a full-time job. Between the documentation, the denials, and the appeals, insurers don’t exactly roll over and write a check.

What a lot of people don’t realize, though, is that while you’re jumping through hoops to prove your claim is real, the company might be sending someone to prove it isn’t, complete with a camera and a very long lens.

One private investigator recently showed just how far that goes.

Did You Know They Hire Private Investigators?

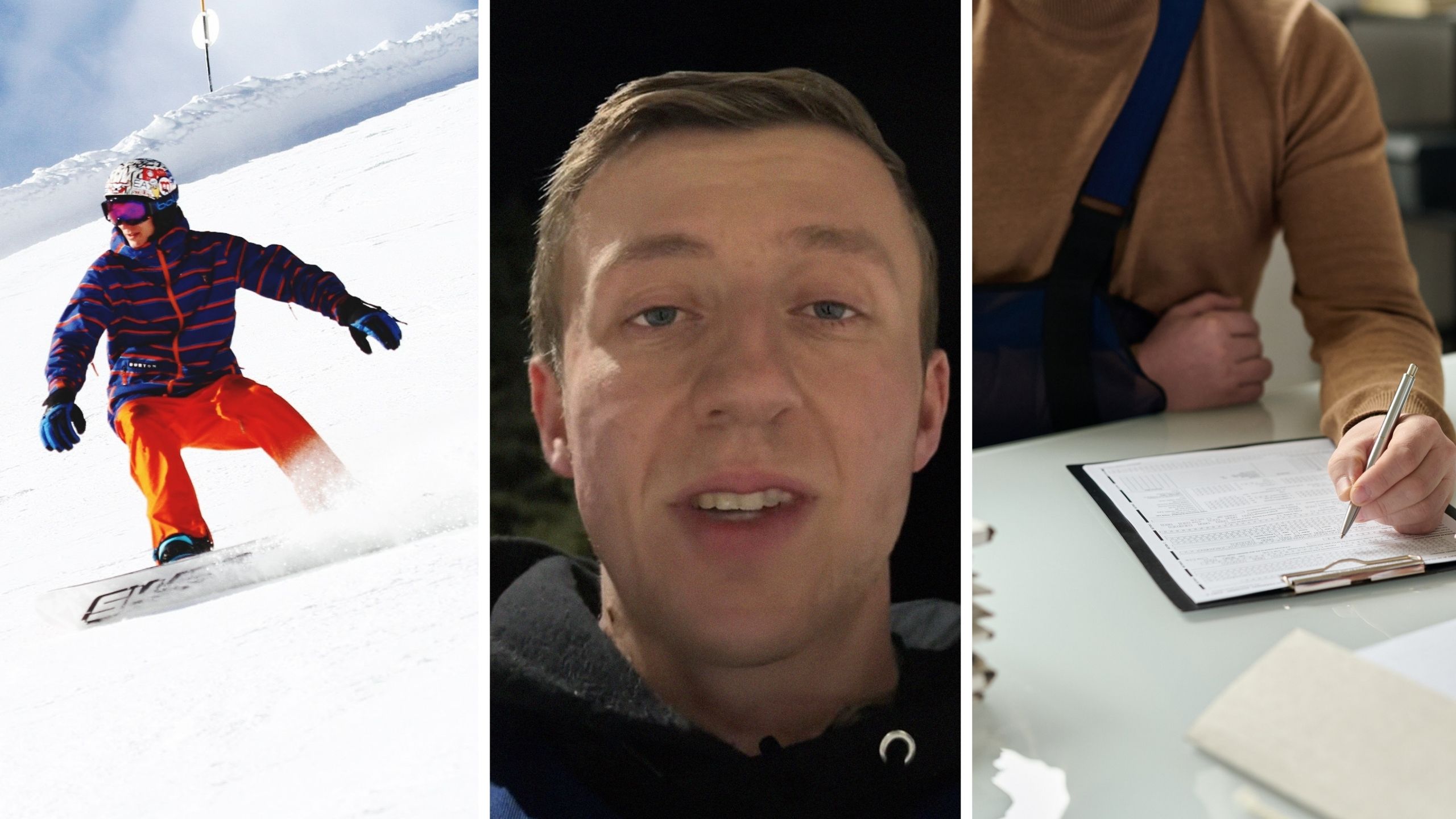

In a viral TikTok with more than 162,000 views, Brandon (@brandonbodnarchuk77), a private investigator, filmed himself on the job at Seymour Mountain (a ski resort in British Columbia), where he’s been sent to surveil a man claiming a workplace injury.

“Private investigator catches insurance frauder snowboarding,” he explains in the text overlay.

“Hey guys, I’m a private investigator working an insurance file at Seymour Mountain,” Brandon says into the camera, “and the guy is claiming an injury. And he’s here snowboarding.”

Then, right on cue, the man in question glides into frame. He slowly makes his way down the snowy hill.

“There he goes,” Brandon says. “Completely lying about his injury. His employer will love that.”

“Fun one the other day,” he added in the caption.

Yes, Insurance Companies Really Do This

If the idea of an insurance company sending a private investigator to tail you feels a little extreme, it’s actually pretty standard practice.

According to Mahaney & Pappas, a Massachusetts personal injury firm, insurers hire PIs specifically to gather evidence they can use to deny claims or pay out less than they should.

Investigators are given a claimant’s full personal information—name, address, employer, even school—and will follow them to work, run errands, and yes, do recreational activities. They’ll take videos and photos as well as build out day-by-day timelines. And, in some cases, they will even show up at the door pretending to be a salesman just to observe someone walking around.

They also comb through social media, looking for anything that contradicts what a claimant says about their injury. The more serious and high-value the claim, the more likely a PI is going to be involved.

The Bigger Picture On Insurance Fraud

According to the Insurance Information Institute, insurance fraud costs the U.S. economy $308.6 billion annually. And per Progressive, the FBI estimates non-healthcare insurance fraud alone runs about $40 billion a year. It’s a cost that gets passed to consumers in the form of extra premiums.

Fraud can range from hard fraud, which is deliberately faking an injury or staging an accident, to soft fraud. Soft fraud is more common and involves exaggerating a real claim for a bigger payout. Both are illegal.

Commenters React

“Insurance companies doing anything but paying,” a top comment read.

“Bro not every injury hurts everyday. Coming from a nurse with back injury some days I can workout some days I can’t get out of bed,” a person said.

“Insurance itself is fraud,” another wrote.

“Anything to deny a claim, right? Insurance companies are only good at marketing, collecting premiums, and denying claims,” a commenter added.

@brandonbodnarchuk77 Fun one the other day. 🕵️♂️ #privateinvestigator #insurance #fraud

BroBible reached out to Brandon (@brandonbodnarchuk77) for comment via text message and TikTok direct message.