The Water Coolest is a free daily business news and professional advice email newsletter created for weekday warriors that is delivered fresh daily at 7 AM EST. Dig the insight? Sign up to receive the daily email newsletter …

[protected-iframe id=”0b68b18a05f7cab8f4d27d2e4fbee4f6-97886205-133320964″ info=”https://www.thewatercoolest.com/brobible-form/” width=”600px” height=”100px” frameborder=”0″ scrolling=”no” allowfullscreen=””]

THE HEADLINES

Don’t have 3 minutes and 59 seconds to read The Water Coolest? Listen on all of your favorite podcast outlets in 2 minutes or less.

EVERYTHING MUST GO

Hudson’s Bay will sell most of its European business to Signa Retail Holdings of Austria. The Canadian clothing purveyor will merge its German entity with Signa’s Karstadt Warenhaus department store.

Signa will also receive 50% of The Bay’s real estate assets in Germany. After the dust settles, the seller of only the finest Canadian tuxedos will walk away with $411M.

Hudson’s Bay is the parent company of Saks Fifth Avenue, Lord & Taylor, and its own namesake department store. You may have heard that they’ve been having a tough year. And truthfully, it’s been a rough few years. Earlier in 2018 the company announced it would be selling off Gilt Groupe, and closing the doors on its flagship Lord & Taylor store.

Water Cooler Talking Point: “The retail sector is like watching a car crash in slow motion, on repeat … for the past decade.”

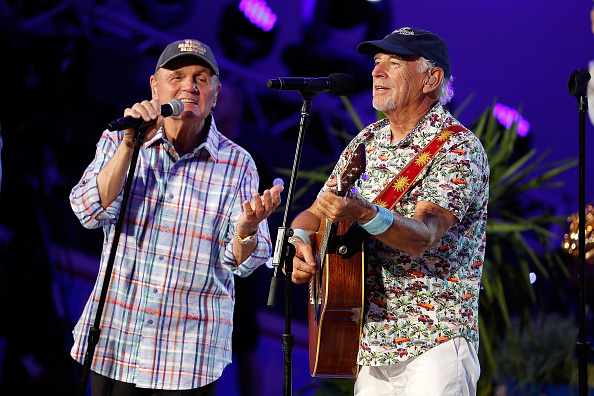

WASTING AWAY AGAIN IN MARGA-REEFER-VILLE

Getty Image

Jimmy Buffett is going green with the help of Wrigley heir Beau Wrigley Jr. After 40 years of playing in the Coral Reefer Band, Buffett will be licensing the name out to Wrigley-backed Surterra, a Georgia based cannabis firm.

Surterra can currently operate in Texas and Florida, and as recently as last month had raised $65M from Wychwood Asset Management, an investment firm run by Wrigley Jr. Buffett will not own any stock in the company, but he will channel his inner Mr. Wonderful and earn royalties on any Coral Reefer products sold.

Buffett chose Surterra because of their focus on the medicinal attributes of the plant. Fun fact: the company will be peddling chronic of the non-prescription variety.

Water Cooler Talking Point: “When will all these baby boomers quit getting stoned and go find a job? Those septuagenarians always expect everything to be handed to them.”

THE PERFECT STORM

Pixabay

It’s almost fitting that the 10 year anniversary of the financial sh*tstorm that brought the US to the brink will be marked by a natural disaster straight out of a Dennis Quaid movie. Meet Hurricane Florence. This cyclone is the Ivy-League-educated, bulge-bracket-employed, pedigreed elitist of hurricanes: 140 MPH winds, 24+ inches of rain, and a storm surge approaching 20 feet.

- Facebook will try to earn some brownie points by promoting the use of its Community Help feature which allows disaster survivors to mark themselves as safe.

- Pfizer, Boeing, and Volvo will shutter plants in North and South Carolina in the coming days. Don’t for a second think they are above blaming future lackluster earnings on the lost productivity.

- Debt issued by the governments of North and South Carolina’s remains largely unchanged. Surprised? Don’t be. Moody’s claims that no municipality has ever defaulted because of a natural disaster. Mostly because the areas are buoyed by insurance money and federal aid.

Water Cooler Talking Point: “For the love of Dale Earnhardt, please leave your double-wide if you’re asked to evacuate. Stay safe out there, Weekday Warriors.”

IN OTHER NEWS

iStockphoto

- Jack Ma is proving he’s still got a little bit of fight left in him. Alibaba will partner with Russia’s Mail.Ru and other oligarchical organizations to build a digital “Silk Road” that will foster e-commerce in the region. What does this all mean? The cohort will expand current e-commerce platforms (Mail.Ru Group’s Pandao and Ali Baba’s AliExpress Russia) as well as build infrastructure to facilitate growth in the underserved Russian market. This is the stuff of Uncle Sam’s geopolitical nightmares.

- Japanese chip-maker Renesas will buy Cali-based Integrated Device Technology for $6.7B. Because, you know, synergy. IDT’s technology focuses mostly on next-gen vehicles making it the belle of the proverbial ball. But the Japanese Prince Charming might have a hard time sweeping IDT off its feet if US regulators have anything to do with it.

- The Office of the Comptroller of the Currency told Wells Fargo to hold their stagecoach-pulling horses. The US lender that’s making compliance cool again vowed to pay back customers charged for unnecessary auto insurance, but the OCC wasn’t convinced Wells had collected a full list of those affected and rejected the bid.

- The FCC is giving slow-cooker a new meaning. The commission is pausing the self-imposed “180-day transaction shot clock” on the Sprint-T-Mobile deal. It’s citing the need for more time to kick the tires.

You can subscribe at thewatercoolest.com.