The Water Coolest is a free daily business news and professional advice email newsletter created for weekday warriors that is delivered fresh daily at 7 AM EST.

Signup for the blue-chip daily business news, professional advice, and personal finance email newsletter …

[protected-iframe id=”17d51bf49abc1cd1bfe83af5badc9a08-97886205-133320964″ info=”cdn-images.mailchimp.com/embedcode/horizontal-slim-10_7.css” ]

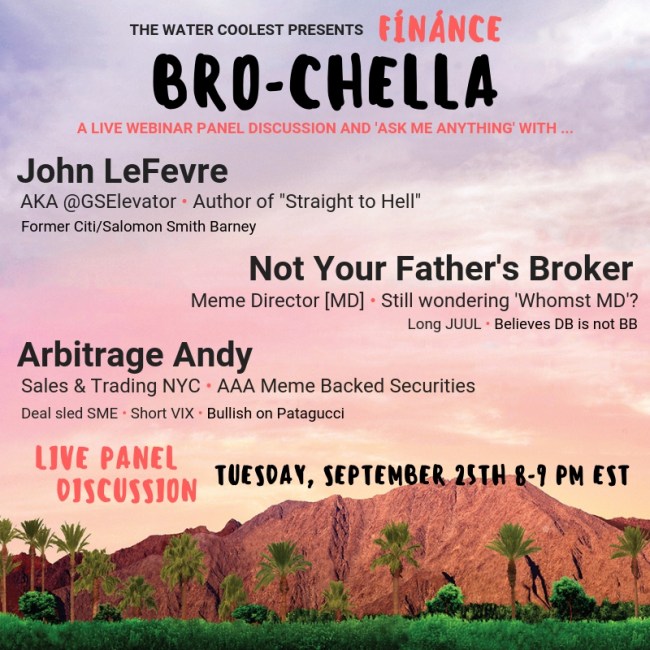

The Water Coolest is hosting a live 1-hour webinar panel discussion and Q&A with the G.O.A.T.s of fínánce social media: @GSElevator (Twitter), @NotYourFathersBroker (IG), and @Arbitrage.Andy (IG).

LIVE ON TUESDAY, SEPTEMBER 25th 8-9 PM EST

THE HEADLINES

Don’t have 3 minutes and 48 seconds to read The Water Coolest? Listen on all of your favorite podcast outlets in 2 minutes or less.

WORKING FOR THE WEEKEND

What’s a fledgling media goliath to do when it continues to bleed clients to the likes of Netflix and other cord-cutting providers? Overpay for more clients that it can lose with reckless abandon, of course.

That’s exactly what Comcast did over the weekend, “winning” Sky in a head-to-head auction vs. Fox. Comcast spent £17.28 per share, or roughly $38B. Keep in mind that Fox’s initial bid for Sky was £10.75 per share and Comcast’s first counter came in at just £12.50 per share.

In a state-controlled bidding war that went to final, sudden-death (under the rules of engagement, after two rounds of bidding, the auction goes to a final, winner-take-all closed bid) Comcast paid a massive premium vs. Fox’s £15.67 bid. Somebody failed Game Theory 101.

Technically Comcast “won” the 21-month bidding war, but at what price? Aside from overpaying, Comcast hasn’t seen the last of Fox. Rupert Murdoch and the rest of the cast of Succession (read: Fox) own 38% of Sky. The major stockholder can surely sway approval of the bid, or, of course, they can always just say “f*ck it,” pop bottles, and hit the south of France, because they just bid up the value of their own shares.

(Don’t worry, you’re not alone, we’re also curious how this is kosher.)

Water Cooler Talking Point: “I’ve got a bone to pick with this auction process: these two companies duked it out for 21-months, fighting tooth and nail for the right to own Sky … all during normal business hours. Then the British regulators come out of left field like ‘Lads, let’s get together and settle this on a Saturday, shall we?’ Hard pass.”

YOU TALKIN’ TO ME?

iStockphoto

China has called off trade talks with the US, citing their unwillingness to cave to pressure. This, after Beijing retaliated with tariffs on an additional $60B worth of US imports following Trump’s $200B tariff announcement last week.

$200B of Chinese products will be subject to tariffs as of 12 PM Beijing time on Monday, adding to the tariffs on $50B worth of goods announced earlier in the year. Roughly $110B of US products will be subject to Chinese tariffs as of Monday. Talk about a case of the Mondays.

The $250B of Chinese goods represents roughly half of the value of all imports from China last year. For those keeping score at home, the $110B of US products accounts for approximately 70% of imports from America in 2017. Size matters, Xi.

Talks will likely pick up after the US midterms in November when both Trump and China believe/hope they’ll have more leverage. And if China does run out of products to tax there are thoughts that it may target American businesses operating in China, although their economic advisor Liu He has strongly denied those claims.

Water Cooler Talking Point: “Can’t wait til President Xi has too much baijiu next weekend and sends a 2 AM ‘I miss you’ text to the Donald.”

IN OTHER NEWS

iStockphoto

- Uncle Sam is doing his best to stop big pharma from providing no-cost nursing care and reimbursement assistance to patients and doctors. Wait, what? Federal prosecutors are probing major drug manufacturers like Sanofi, Gilead, and Biogen over claims that they are providing incredibly low-cost, life-saving services. Absolutely abhorrent behavior. Always the cynic, the feds suspect drug makers are doing this to illegally gain a leg up on the competition.

- Point: tree-huggers. Porsche, the preferred luxury vehicle of execs experiencing a mid-life crisis, has vowed to discontinue diesel engines, partially because of hybrids growth and mostly because it’s owned by VW, of diesel-gate fame.

- Luxury fashion e-tailer, Farfetch, IPO’ed at $20, above its expected range of $17 to $19. Shares popped 35% on day one continuing the trend of really, really, ridiculously successful 2018 IPOs.

- A game of chicken. That’s what McDonald’s and the New York State Common Retirement Fund are playing. The New York pension fund, the third largest in the country, which owns $300M worth of McDonald’s shares warned the golden arches that its time to take better care of their chickens … or else. The threat comes as animal rights groups and celebrity activists step up pressure on the chain.

You can subscribe now …

[protected-iframe id=”17d51bf49abc1cd1bfe83af5badc9a08-97886205-133320964″ info=”cdn-images.mailchimp.com/embedcode/horizontal-slim-10_7.css” ]