The Great CryptoCurrency Boom of 2017 is like watching a wild pinball machine — The price of cryptocurrencies like BitCoin seems to skyrocket for a new reason every single day. After a dip down to $2200 at the end of May, BitCoin is soaring at close to $3000 per. While some analyst forecast $100,000 prices in a few years, veteran investors like Mark Cuban aren’t buying into the hype.

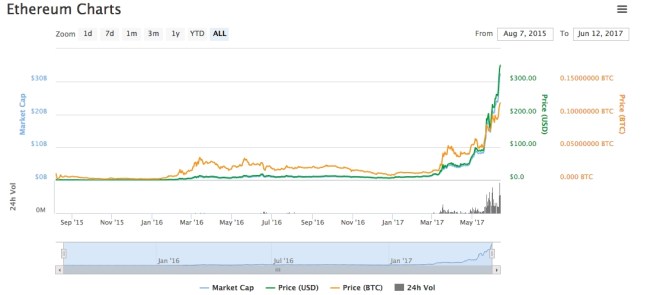

Which leads us to Ethereum, a BitCoin alternative that’s hockey-sticking like crazy in price. Just six months ago, in the middle of January, Ethereum was priced around $10 per unit. It’s experienced almost 3600% growth since then, now trading at $360 per unit. Your $500 investment in Ethereum six months ago would be worth $18000.

So what is Ethereum? Here’s the best summary I could find. In short, it’s cryptocurrency makes transactions wayyyyyyy easier than BitCoin. In short, you can actually use it like *real* currency rather than waiting for a BitCoin transaction to process. Just like handing over cash or swiping your card! via The Australian.

Ethereum was launched in 2015 by a group of programmers inspired by the success of Bitcoin, but instead of just making a currency that worked off blockchain and was “mine-able” with computing power, the platform they created allows for “smart contracts”.

The problem with Bitcoins, as I understand it (I don’t own any, and have never used them to buy anything) is that transactions can take anywhere from 10 minutes to hours, depending on how busy the network is. It’s also fairly expensive to use, especially for small transactions.

Ethereum, on the other hand, takes 12 seconds to transact and is much cheaper, but it’s also much more than a currency: it’s a platform for something called decentralised applications (dApps) that run on peer to peer computer networks and are designed to disintermediate all kinds of transactions that currently require banks, stock exchanges and the legal system itself.

Everyone is now flocking to the Ethereum side of the boat, it seems. In March, 116 organisations formed Enterprise Ethereum Alliance, including Samsung, Microsoft, Intel, JP Morgan, Deloitte, Accenture, Banco Santander, ING and National Bank of Canada.

The news earthquake that may have caused last week’s Ethereum tsunami comes from Russia and China, two of the biggest economies in the world, both of which are considering using Etherum to digitize their currencies.

Time to buy the ticket, take the ride? Stay tuned.