Getty Image

The NBA is far and away the most popular basketball league in the world, but that wasn’t always the case. You may be aware of the merger that helped it obtain that status, but you may not know about the owners of an ABA team who managed to make hundreds of millions of dollars in the decades following that deal despite shuttering their franchise.

Owning an NBA team in this day and age tends to be an incredibly lucrative venture thanks to the wildly popular nature of the league, but that wasn’t always the case.

The NBA was founded in 1946, and while it quickly cemented itself as a premier destination for talent, it wasn’t the behemoth it is today thanks in no small part to the competition it faced from the American Basketball Association (ABA), which played its inaugural season in 1967.

The ABA—which set itself apart with a focus on offense made possible with the help of an (at the time) innovative three-point line—attempted to poach players (and referees) from the NBA with the help of comparatively lucrative contracts, but the expenditures it relied on to get off of the ground ended up catching up to a league that ultimately found itself facing fairly dire financial straits.

That led to the NBA-ABA merger that was finalized in 1976—an agreement that made a couple of owners who theoretically got the short end of the stick very rich men.

The owners of the Spirits of St. Louis used the collapse of the ABA to get $800 million from the NBA thanks to a shrewd television deal

Getty Image

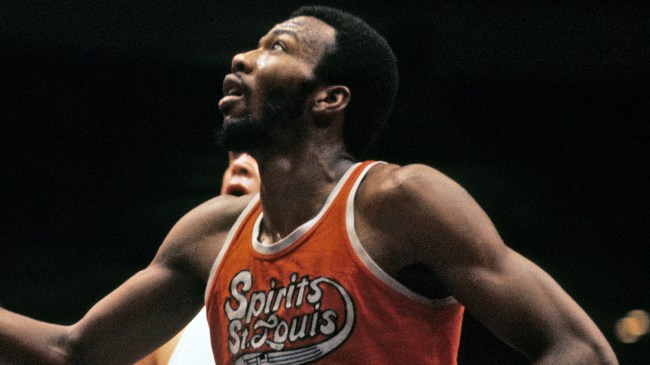

The ABA had a bit of trouble finding its footing, and there’s no better way to highlight that reality than taking a look at the tumultuous journey of the team known as the Spirits of St. Louis.

That franchise was dubbed the Houston Mavericks when the ABA played its first season in 1967, but it only survived in that city for two years before relocating to the East Coast and rebranding as the Carolina Cougars.

While they technically found more success in their new state, the bar was set pretty low, and in 1974, they moved yet again to the city that lent its name to the plane Charles Lindbergh used to become the first person to fly solo across the Atlantic Ocean.

That pivot was made possible by Ozzie and Daniel Silna, a pair of brothers from New Jersey who were able to purchase the team with the fortune they’d earned after starting a wildly successful polyester business around the same time the fabric started to take the fashion world by storm.

At the time, St. Louis was the largest city in the United States without a pro basketball team, and the Silna Bros were hoping to not only take advantage of what they viewed as an untapped market but use its unique nature to make the team more attractive to the NBA in the advent of a merger that seemed increasingly inevitable.

However, the Spirits (along with the Kentucky Colonels and the Virginia Squires) were ultimately left out in the cold, as they failed to receive the invitation the NBA presented to the Nuggets, Nets, Pacers, and Spurs when it agreed to absorb the ABA.

The Squires went bankrupt before they could even receive a consolation prize, although the Colonels were able to hang around long enough to get a $3.3 million check from the NBA for their troubles.

The Spirits were initially offered a similar sum, but the Silnas sensed an opportunity and eventually negotiated a deal that landed them $2.2 million on top of 1/7 of the television revenue generated by the quartet of ABA teams who survived the merger—a term agreed to in perpetuity.

If you’re not fluent in legalese, “perpetuity” literally means forever, so while the deal may not have seemed that lucrative at the time, that slowly but surely began to change as the NBA became an increasingly profitable venture thanks in no small part to its TV partnerships.

In 2012, The New York Times reported the Silnas had made a total of $255 million over the course of around 35 years by doing absolutely nothing (it’s worth noting the lawyer who negotiated the contract got a well-deserved 10% cut).

While they turned down multiple buyout offers over the years, they eventually agreed to one that netted them $500 million on top of the $300 million they’d earned (although it’s believed they lost a significant amount of that second sum after investing an unknown amount with a New York City financier by the name of Bernie Madoff).

Not too shabby.