Getty Image

Before we get started, I need to say this (or feel like I need to because I see all of the great stock market gurus say something along these lines):

I am NOT a financial advisor and everything I talk about is NOT investment advice (unless you want to be rich). I am not licensed in any way, so take everything I say with a grain of salt (but I’m also kind of rich now, so do with that what you will). I am simply an economics major with no job who recently made about $100 on Robinhood. The choice is yours.

***

When you come out of college and start making a little dough, you cannot spend it fast enough. This is the first time you have money, so it feels like everything is free. No more asking your parents for $30 to take Kelly out to a nice Panera lunch. No, you worked hard all week, which earned you the right to swipe that magic card full of your own money and pay for that $14 sandwich yourself. It still probably won’t get you laid, but at least she can tell her friends you were a gentleman.

When you pay for something with a card, it’s really easy to tell yourself you just beat the system, as it doesn’t feel like real money. This is 2020. You aren’t using cash anymore. No, you’re either Venmoing your friends or accumulating debt under the guise of earning travel points and building credit. All you do is click a button every month and you get to keep using that plastic. It’s amazing!

It doesn’t take long for spending money on things to become a habit. After all, what good is having an overpriced apartment if it’s not stocked with some high-end liquor used exclusively for shots and mixed drinks?

Soon, you increase your betting unit yet continue to lose the same 76% of the wagers you place. You then start to buy things that absolutely do not fit your budget, like a drink at Starbucks that’s easy to justify when you’re only spending $5 a day on it but much harder when you realize that translates to $1,825 over the course of a year. Did you really need that $300 drone to kickstart your YouTube career even though you work in a cubicle and don’t know how to edit videos? Probably not, but you buy it anyway because you can.

Doing this for a few years is great, but sooner or later, your lifestyle is going to catch up to you. You begin to realize “Ohh shit, I’m kind of broke.” Your first thought is to maybe chill on the new purchases and start to cut back, but even though your friends have all had the same realization, you can’t be the first to suggest a change in lifestyle, as they would cut you out immediately.

You then decide to look for new ways to make money. The irony here is that everyone in your group all has this same feeling, but in fear of being the first broke loser to suggest you might not need to go to Club TRIC three times a week, you keep up the expensive lifestyle just like everyone around you.

If everyone was honest, you would all want the same thing, but ego is a powerful drug and you don’t want to come off as poor. You’ve heard Gary Vee talk about the term “multiple sources of income” so that must be the answer, and given the many different ways to make an extra buck online, it must be pretty simple.

The YouTube career didn’t take off. Neither did the t-shirt company. Or the eBay reselling. Worst of all, sports are canceled, so the gambling that was once your only secondary source of income has now been completely shut off. Now what?

Stuck in a kind of entrepreneurial purgatory, you feel hopeless. Then one day, you’re scrolling through social media and you come across a few posts like these.

https://www.tiktok.com/@realjakoba/video/6833147951582416133?u_code=d2fg7m38i7hll7&preview_pb=0&language=en&_d=d98cbekjk2848i&share_item_id=6833147951582416133×tamp=1591896708&utm_campaign=client_share&app=musically&utm_medium=ios&user_id=6611271267013345285&tt_from=sms&utm_source=sms&source=h5_m

@realjakoba 💰 How ANYONE Can Become a Multimillionaire! #KeepingItCute#voiceeffects #money#epic#success#entrepreneur#teen#foryou#foryoupage#garyvee

♬ Say So (Instrumental Version) [Originally Performed by Doja Cat] – Elliot Van Coup

Any teen can become a millionaire? Sold. What better sign from the finance gods than a photo of the guy on the $100 bill with a quote like that. I felt like Ben Franklin was talking to me directly. After months of trying to secure that extra source, I realized investing was the answer.

If people like Jordan Belfort or TikTok star “RealJakoba” can become multi-millionaires at such a young age by investing in the stock market, you can too, right? That’s where the familiar hypothetical ends and my story begins. Once I saw the posts above and did a little more digging on Finance Instagram, I decided this was my solution.

In order to keep up my lifestyle and continue Ubering everywhere to avoid the subways that are dirtier than I prefer, this is what I had to do. The world may be burning and the economy is in the throes of a recession but I figured now would be the perfect time to take my hard-earned money and bet on the stock market. I didn’t necessarily feel good knowing I was about to get rich by betting on the struggling markets, but I had to do what I had to do.

So, I downloaded Robinhood and got to work. If you don’t know, Robinhood is the app where millennials invest. Founded in 2013, it made a huge impact on the financial industry as the first app to not charge fees for trades and since then, other major companies have eliminated their fees in order to keep up.

Robinhood was great for kids like myself who had no clue how to manage money; all you need is a smartphone and you’re in. Young people could start to invest, and while they could easily lose money, they were at least able to feel like they were being financially savvy and that’s really what it’s all about. However, I quickly realized I had no clue what I was doing and needed a mentor.

My goal here was to become a millionaire, and after a few minutes of research, I found my guru: Tim Sykes, a.k.a. The Penny Trader. His ironclad logic was simple to follow: buy stocks that are under $1, wait until they go up, and then sell. Boom. You’re rich.

“Pump and dump” is the term they use to describe this strategy, and even though a quick Google search of the term may make you think it’s a scam, I knew it was foolproof based on Tim’s Instagram posts showcasing his “views from the office.” Look at him! He’s working in the pool! How could you not buy his $1,500 course on investing???

https://www.instagram.com/p/BzQzeYOJjB7/

I’ll be honest: after spending about three days following the Tim Sykes Method, I got fed up. This man wanted his students to study the markets all day, every day. We had to do research before trading began, pay close attention from opening to closing bell, and then do even more research afterward. Sorry, Tim. I am here to get rich quick, not to do homework. While I was certain the methods were foolproof, I also understood they weren’t for me. So, I took my realized losses (finance term) and moved on.

What was next? I knew what my goals were and I knew I wanted to be in the markets but there had to be a better way. I knew there had to be more investing coaches out there who have different strategies. I just had to find them.

Being the critical thinker that I am, I knew my best chance to find the right coach was to find the person who was living the best life imaginable on the ‘Gram. I set off on a hunt for the kind of guys we all know and look up to; the ones you know definitely made a ton of money from investing because they are constantly staring at complex screens, frequently on vacation (but never with the same girl), and, of course, always wearing those see-through white button-downs.

https://www.instagram.com/p/CBRepAxhO3t/

https://www.instagram.com/p/CBPClB3ptpN/

I had a lot of good options, and after my failure with Tim Sykes, I figured I’d follow all of these guys, aggregate the information, and invest through Robinhood using my own “super-strategy.” I wanted to be the next Bitcoin Billionaire and the guy who always has a hot stock tip, so that is exactly what I would become.

Originally, I wanted to invest passively and not work that hard, but after seeing the two graphics below and realizing this business was all-or-nothing, I knew what I had to do.

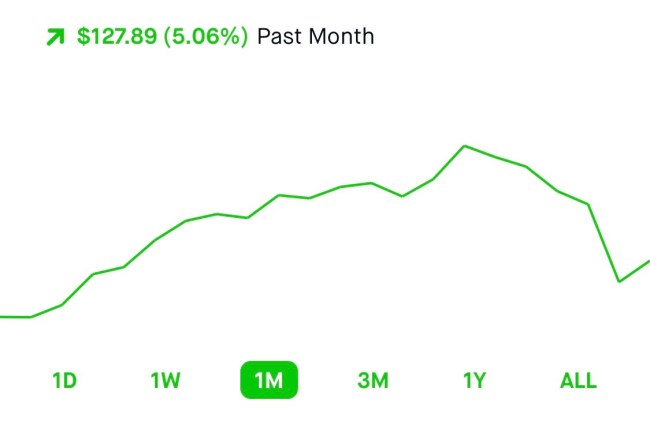

Given the harsh realization that I only had two options when it came to living arrangements—a trailer park or a mansion—I immediately traded in my friends and Netflix subscription for books, education, and hard work. I’ll be honest: this was a tough pill to swallow. I started to question if I should have stopped conversating with lifelong friends without explanation, but after seeing that $127.89 increase in my Robinhood account, it was all worth it.

Since then, I have been investing in everything from cryptocurrencies to ETFs, a cool finance thing I learned about a few days ago. All has been going great. I just bought three different pairs of Sperry’s and have been reaching out to boat rental companies to see if I could take a couple of photos on a yacht. I haven’t had any luck so far but I know when they see my success, they’ll eventually have to cave.

Am I happy with where I am at? Yes. Satisfied? Absolutely not. I am hungrier than ever. Now is the time to turn up the heat and reinvest the money I have made. I would love to book a trip to Bali as any good investor does but I know I’m not quite ready. While I am bullish on the TJ Francis investment portfolio, I am bearish on jumping the gun too quickly. I need more sources of income and more security.

In my quest to not only make money in the markets but become a lifelong entrepreneur so I can eventually work in a hot tub and call it my office, I have to do more. With that said, I have put serious thought into creating my own online investing course, and given my recent success, I see no reason why anyone would have a problem with my starting price of $499. I’m giving away hours and hours of knowledge at a bargain because I am for the people.

While I begin to outsource the administrative tasks like “making a website” and “actually putting the course together,” I wanted to give away a little bit of my expertise for free. It’s nothing crazy but I’m happy to relay a few hot stock tips to both earn trust from aspiring investors and get you guys a couple of extra bucks in your pocket as well.

1. Macy’s, Inc (NYSE: M)

Macy’s was recently broken into by looters in New York City. At first glance, you would think that they would take a hit—especially as commerce moves online—but the smart investor always thinks long term.

Yes, Macy’s might come up a little short in their bottom line next quarter, but after a few months, all of those people wearing their new clothes will stick out and other people will start to take notice. The occasional passerby will stop in their tracks and ask, “That’s a cool shirt, where did you get it?” and they’ll respond, “You’re not a cop, are you?” before saying “Macy’s” in a hushed voice if they aren’t.

The other person will then likely cancel their plans for the rest of the day and redo their entire wardrobe with some online shopping. While some would look at what happened and be weary, I see it as free marketing.

I’m very bullish on Macy’s, and if you like money, you should be too.

2. The Hertz Corporation (NYSE: HTZ)

Sure, Hertz recently filed for bankruptcy thanks in no small part to a business model that relies on people to rent cars at airports that have been virtually empty since March. However, it was already in its death throes because ride-sharing had dismantled the car rental industry as a whole and this was probably a matter of time.

When framed like that, it’s easy to see why no one would want to touch Hertz and that’s exactly why it’s such a steal.

As I would hope you know by now, the name of the game is “buy low, sell high.” Hertz has been trading at about the lowest it’s ever been but a pillar in the market surely just won’t go under, right? With a YTD high of $20.25 and a recent 896% increase from its all-time low on May 26, Hertz is on its trek back up to the top and is foaming at the mouth to pay its investors.

3. AMC Theatres (NYSE: AMC)

It’s no secret that streaming services have put a sizeable dent in the movie theater business. With the introduction of the likes of Netflix, Hulu, and Amazon, people have been ditching the $9 popcorn and just waiting for the summer blockbusters to come out digitally. When we were all ordered to stay-at-home, theaters took an even bigger hit.

Some have even called for the complete shutdown of all theaters, thinking there’s no way they can recover. I, however, am one for nostalgia. Call me crazy, but I think once this lockdown ends and people can kiss each other on the lips again, everyone will be rushing to the theaters to see Jumanji 4 with their crying baby, sending that stock price through the roof.

My strategy is simple: don’t look at any of the financial numbers like EBITDA or PE ratio but go off gut feeling instead. My gut is telling me those are all winners.

After months of investing and letting my money work for me, I can now safely say, “Yes, I would love to go to Chipotle” about 10 different times before I have to start making up excuses for why I can’t. I hope I never have to think twice about getting fast-casual again but I know it’s going to take more hot stocks and savvy investing (unless more of you buy my investment course “Quick Investment Strategies to Make Your Boat Your New Office,” which will be available soon).

Again, I am not an investment or financial advisor by any means. I am just a once poor kid who was looking for ways to make a couple of bucks in the absence of sports betting. Once I can wager on games again, I’ll be the first one to ditch that Robinhood account and text my bookie (whose real name I do not know), but for now, the stock market is all we got.