The Water Coolest is a free daily business news and professional advice email newsletter created for weekday warriors that is delivered fresh daily at 6 AM EST. Signup here to receive The Water Coolest every weekday.

THE HEADLINES

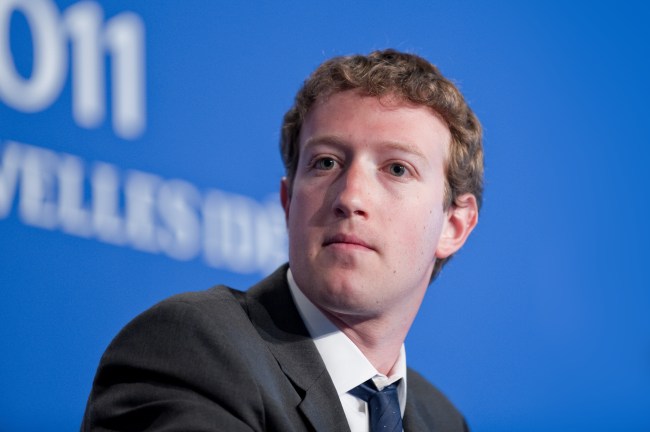

NOW IT’S PERSONAL

iStockphoto / FLDphotos

“You better lawyer up asshole, because I’m not coming back for 30%, I’m coming back for EVERYTHING.” – Eduardo Saverin … and the FTC, probably

A Friday Washington Post report indicated that the FTC is considering directly legal action against Mark Zuckerberg related to Facebook’s privacy faux pas … and at least partially because he’s a “little weasel who deserves to be stuffed in a locker.”

Rumors have been swirling for some time that the preferred social network of your aunt Kathy who thinks “LOL” means “lots of love” and the FTC are close to a massive multi-billion dollar settlement related to the Cambridge Analytica sh*tshow … but it just got personal.

Why?

Way back in 2011, Facebook pinky promised the FTC that it totes wouldn’t be reckless with data anymore. The agreement stemmed from claims that The Social Network changed privacy settings without user’s consent.

It didn’t take long for Myspace Tom’s more successful, younger brother to begin doing whatever he damn well pleased with Facebook user’s data again. Of course, Zuck’s magnum opus was allowing Cambridge Analytica to harvest some 90M user’s data on the way to shaping the US election.

In a 2018 Congressional hearing, Zuck mentioned that the buck stopped with him, and it appears the FTC seems to be taking that pretty, pretty literally. But if we’re being honest, the FTC is likely just trying to make an example out of pretentious internet billionaires and figured who better to start with than Marky Booster Seat?

JUST CHILL OUT MAN

As part of an ongoing battle between founder Elon Musk and a group of vocal short sellers, Tesla is pursuing a restraining order against a man it claims has been “menacing” its employees.

According to court documents, Randeep Hothi dangerously swerved his car at a Tesla 3 on the expressway and injured a security guard in a hit and run. Musk claims that Hothi has a history of trespassing on Tesla property. Of all the transgressions though, the one Elon is likely most upset about is this guy being mean on Twitter.

Randeep, his brother, and a group of short sellers frequently tweet about Tesla’s shortcomings using the tag $TSLAQ. The Musk man’s company claims that Hothi’s actions could cause “great and irreparable” harm to the company. Which must be a euphemism for vehicular manslaughter.

Et tu, Martin?

This isn’t the only run in Elon and Co. have had with “sabotage.” Back in June, after an announcement leaked stating that Tesla was scrapping or reworking 40% of its raw materials at its Nevada Gigafactory, news broke that Martin Tripp (according to Musk), an assembly worker at Tesla’s factory, had spread the story.

After suing Tripp for $167M, citing “extensive and damaging sabotage,” an anonymous tip was submitted to local law enforcement claiming that Tripp was planning a violent attack at the factory.

Sh*t is getting real

Beefing with a hater (or a British rescue diver) is one thing, but squabbling publicly with a key supplier is another thing. And that’s just what Elon has been doing as of late with Panasonic, the maker of its lithium-ion batteries. Recently Panasonic took to the airwaves to indicate it was not increasing production due to sales concerns. Shots fired.

In a move that’s risky even by Musk’s standards, the prolific tweeter took to the internet to air his grievances with his partner on the Tesla Gigafactory.

Maybe the $TSLAQ crew is onto something …

HOLIDAY, CELEBRATE

Easter? Passover? … 4/20?!

US-based cannabis companies have been all the rage and M&A has been rampant in the space as of late. Just last week we saw former-House Speaker John Boehner backed Acreage Holdings make a deal with Canada based Canopy Growth for “the rights” to a buyout once weed becomes legal in the US.

But not all weed companies are created equal. Case in point: one of the more well-known, and cleverly named, marijuana multi-state operators, MedMen, can’t seem to get its money right or its sh*t together …

On Friday, the company’s COO, General Counsel, and Senior VP of Corp Comms up and left the firm. This comes on the heels of another major departure that raised more than a few red flags.

Former CFO James Parker (no relation to Sean) left MedMen in November and promptly filed a lawsuit claiming that the co-founders improperly spent the company’s cash and created a hostile work environment complete with “racial, homophobic, and misogynistic slurs.”

In the aftermath of James Parker’s departure, other employees were asked to GTFO as CEO Adam Bierman attempted to “make the company more efficient.” The publicly traded pot peddler has yet to hint at any internal strife, but as they say, where there’s weed smoke, there’s fire.

IN OTHER NEWS

iStockphoto

- The Weather Channel was kicked off the air for over an hour last week due to a ransomware attack on the network. Live programming was restored thanks to backup mechanisms that had previously been put in place. Presumably, this is revenge for operating a website that runs about as smoothly as a McDonald’s McFlurry machine.

- BP, Socar, and other minority partners are leading a $6B investment into a deepwater oil-field complex off the shores of Azerbaijan. The Azeri Central East project is designed to process up to 100k barrels a day and up to 300M barrels throughout its lifetime. Its first production is slated for 2023 and Mark Wahlberg’s movie about it will hit theaters in 2029.

- Venmo is looking into launching a branded credit card, barely one month after Apple did the same. The PayPal owned company has been meeting with banks since late 2018 and is apparently close to selecting Synchrony Financial as its partner. This, all in the pursuit of an elusive profit, as Venmo is expected to lose $400M this year.

Ready to become the most well-informed bro in any room? You can subscribe here.