Pixabay

When it comes to your finances, what advice do you wish you had known and listened to when you were younger (or now)?

The team over at Comet Financial Intelligence surveyed over 1,000 people to learn what financial advice millennials and Gen Zers want to know versus the advice they actually receive. They also explored what advice older generations wish they knew at a younger age.

Here’s some of what they learned…

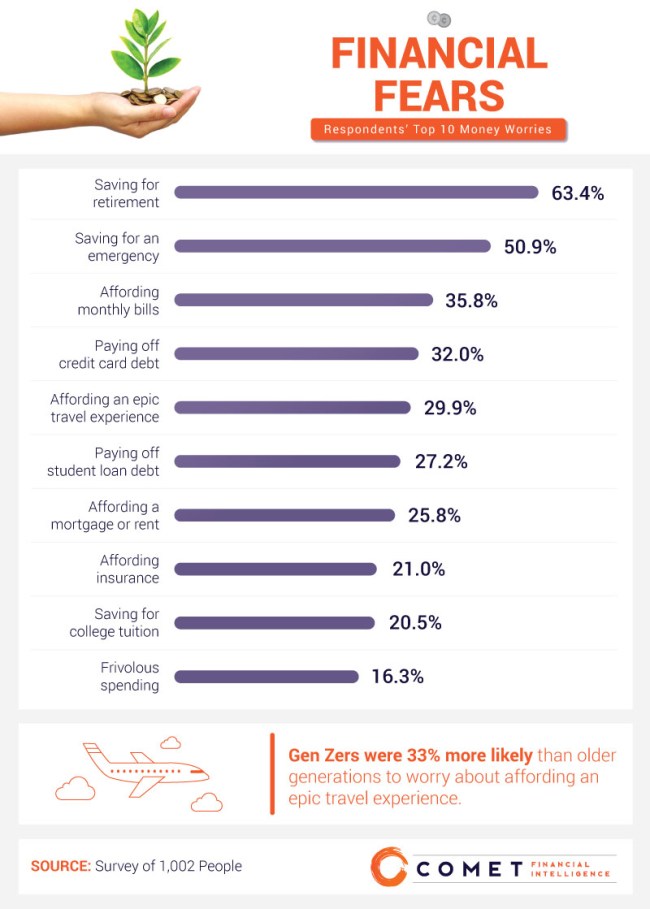

• Saving for retirement and saving for an emergency are the top money worries for every generation.

• Gen Zers are more worried about affording an epic travel experience than paying off student loans.

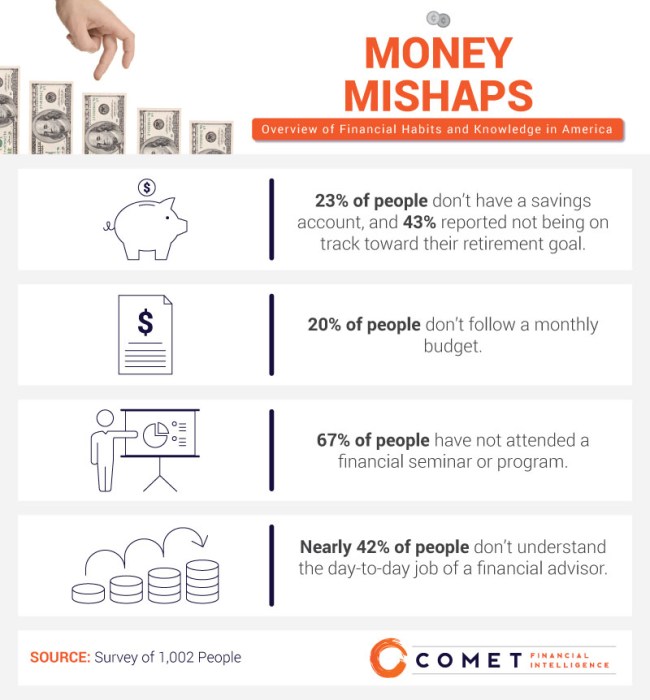

• A large amount of those surveyed don’t have a savings account, don’t follow a monthly budget, and are not on track toward their retirement goal.

• A vast majority of people currently don’t see a financial advisor.

No surprise, retirement is the top financial concern, followed by saving for an emergency, affording monthly bills and paying off credit card debt. All normal things that most people concern themselves with when it comes to their personal finances.

Next on the list though? Affording an epic travel experience – ahead of issues like student loans, rent, and insurance. According to Comet’s survey results, this travel concern was 33% more likely to occur among Gen Zers than any other group.

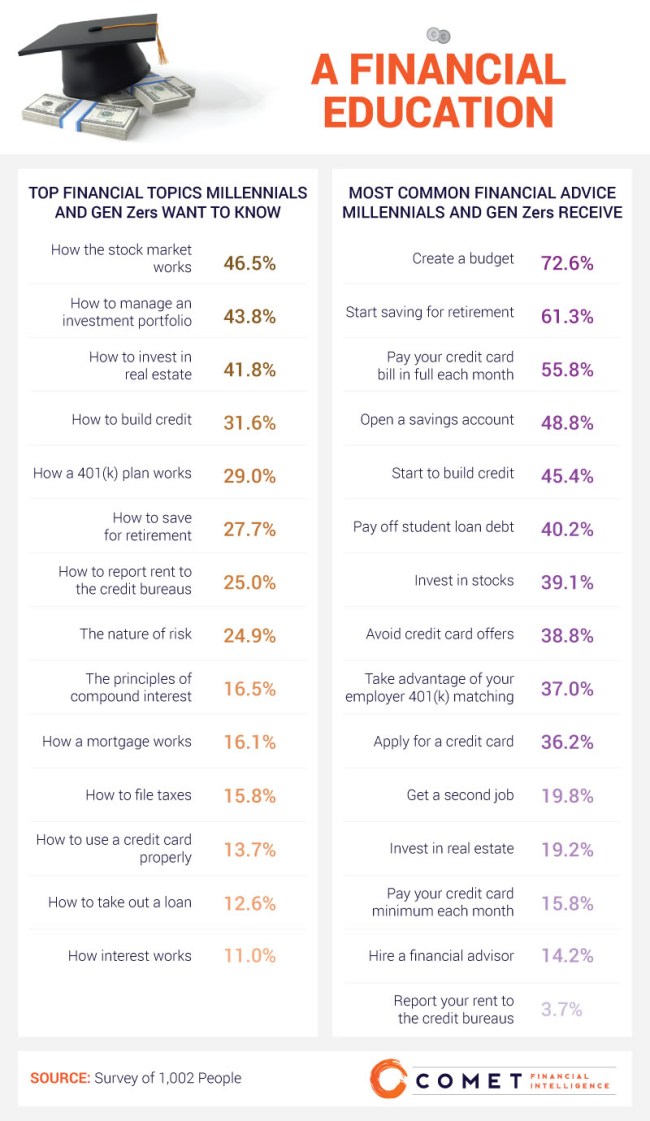

Turns out that a lot of millennials and Gen Zers want to learn more about how the stock market works, how to manage an investment portfolio, and how to invest in real estate. Those also happen to be the same things baby boomers and Gen Xers said they wish they’d known more about at a younger age.

Unfortunately, that’s not the advice millennials and Gen Zers say they are getting. Creating a budget? Saving for retirement? Thanks, but they’ve already heard all about those concepts.

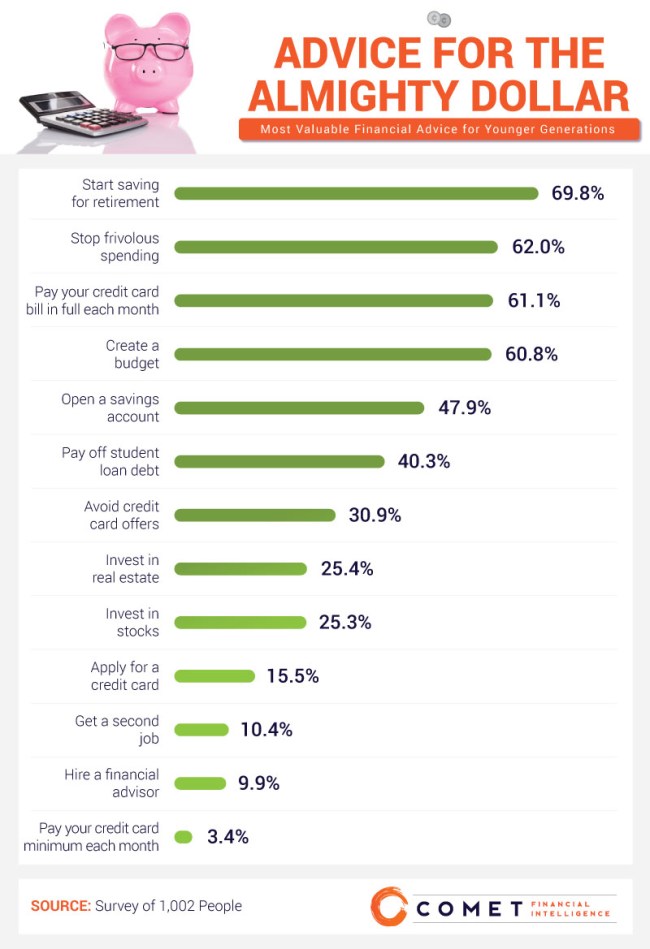

Based on the fact that nearly 70% of the people surveyed think the most important financial advice to pass on to younger generations is saving for retirement, it’s not all bad advice millennials and Gen Zers are getting. They just want to know more about saving than how much money to put in their 401(k).

The olds also want the youngsters to chill with stop frivolous spending, on things like, say, an epic travel experience.

When nearly 42% of people say they don’t understand the day-to-day job of a financial advisor, it’s no wonder 20% don’t follow a monthly budget and 43% are not on track with their retirement goals. And considering Gen Zers are twice as likely as millennials to utilize automated advisor solutions to manage their investments online, it’s no wonder they don’t know what a financial advisor does.

View the complete study over at Comet’s website.