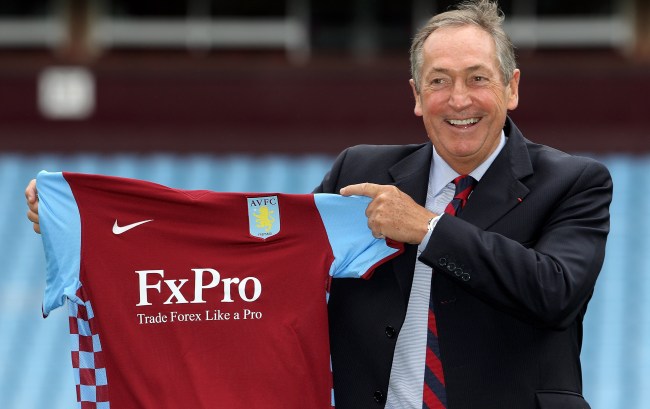

BIRMINGHAM, ENGLAND - SEPTEMBER 10: Gerard Houllier, the new Aston Villa manager jokes as he poses with the club shirt in the dugout at Villa Park on September 10, 2010 in Birmingham, England. (Photo by David Rogers/Getty Images)

Editor’s Note: Welcome to a daily column we run here at BroBible breaking down the day’s biggest stories in sports finance with commentary from the sports money and sports fanatic perspectives. It comes to us via our friends at JohnWallStreet, publisher of a free e-mail newsletter focused on sports related public equities and their subsidiaries. You can sign up here.

Fanatics to Take on Nike, Adidas, Under Armour

Aston Villa Football Club (AVFC) has announced that Fanatics, Inc. will replace Under Armour as the exclusive licensing rights holder for all club merchandise, in time for the 2018-2019 season; but, unlike traditional sports merchandising deals, the company logo will not adorn team gear. Instead, the online retailer of licensed sports apparel will negotiate separate pacts for various pieces of merchandise (think: match-day kit, practice gear, fan apparel) with multiple 3rd parties. The rising value of kit sponsorship deals for the world’s most prominent clubs and the resources required to turn a profit on those partnerships, have left second-tier clubs like Villa with little marketing attention, less merchandise to sell and inevitably depressed revenues; opening the door for a new entrant. With the deal, Villa becomes the first English club to adopt the manufacturing model used in North American sports; Fanatics will manage everything from production to point of sale (including the Villa Park store and e-commerce platforms).

Howie Long-Short: This deal is sensible from the Fanatics perspective because it requires minimal capital expenditure to enter the potentially lucrative English football market. Villa’s status as a second-tier club meant that Fanatics faced little competition for the rights; and the company already maintains production and warehousing facilities in the U.K., properties acquired in their $225 million acquisition of Majestic Athletic. It remains to be seen if the club can increase merchandise sales without a major sportswear label’s logo on their products (hint: they will be), but if successful, sponsorship rights will continue to rise as the traditional players (NKE, ADDYY) look to retain control over the apparel space. Much like cable television providers and sports broadcast rights, the current establishment can’t afford to lose their association with sports teams/leagues and still manage to hit their growth targets.

There are several ways to play Fanatics, as Bank of America (BAC), Alibaba Group Holdings (BABA) and Softbank (SFTBY) are all stakeholders. In September, Softbank invested $1 billion in to the company; bring its total valuation to $4.5 billion (or +/- 2x revenue). For comparison purposes, retailers Dick’s Sporting Goods (DKS) and Hibbett Sports, Inc. (HIBB) currently have market caps ($3.33 billion, $494 million); roughly half of what they generated in 2017 sales ($7.92 billion, $973 million). Of course, Fanatics is far better positioned for long-term success, maintaining (among other advantages, like a DTC model) exclusive long-term licensing agreements with all the major U.S. sports leagues through at least 2030.

Fan Marino: The team’s match-day kit is going to be designed by Luke 1977, a Birmingham based (where the team plays) premium menswear brand. The company’s logo will replace Unibet on the new design. For what it’s worth, Luke 1977 was named the ’10 Young Fashion Brand of the Year, beating out Diesel, Fred Perry and Firetrap in the process.

Interested in Sports? Sports Business? Sports Finance? Sign-up for our free daily newsletter

Twitter to Air Original ESPN Programming, Announces Content Partnership with Disney

Twitter has announced a wide-ranging content and advertising partnership (among 30 renewals and new video deals) with The Walt Disney Company (DIS), as the online news and social networking company continues to invest in video content. The deal, which spans the entire DIS portfolio, includes live original ESPN programming. 2 shows have been introduced thus far, SportsCenter Live (TWTR version of the flagship program) and Fantasy Focus Live (live stream of a fantasy sports podcast). Expect ESPN to share some additional insight on the partnership at their Digital Content NewFronts event on Wednesday.

Howie Long-Short: It’s logical for TWTR to continue to invest in live video content, because it’s working; daily video views on the platform are up +/-100% over the 12 mo. and video is now responsible for more than 50% of the ad revenue. As Global VP of Revenue and Content Partnerships Matthew Derella pointed out, the company’s “super power” is its ability to tie conversation to video during the biggest moment; “giving brands the unique ability to connect with leaned in consumers.” Shares rose 4.5% on Monday’s announcements, closing at $30.31.

TWTR reported Q1 earnings last week, the company’s 2nd consecutive profitable quarter and 2nd profitable quarter ever. Quarterly revenue was up 21% and the company said it expects to be profitable in 2018. Ad revenue is driving the growth, as more brands are shifting marketing dollars from traditional television to digital outlets.

Fun Fact: In 2016, DIS had explored the purchase of TWTR; ultimately passing on the deal amidst concerns of the company’s inability to curb hate speech and trolling on its platform.

Fan Marino: Amazon (AMZN) also recently beefed up its sports video programming, acquiring exclusive rights to stream the U.S. Open Tennis Championships in U.K. and Ireland and renewing its exclusive Thursday Night Football streaming rights through the 2019 season. The 2-year deal worth $130 million (or $15 million more/season than the $50 million paid in 2017), gives the e-commerce giant the rights to stream 11 games during the 2018 season. On May 11th, the cost of Amazon Prime will increase from $99/mo. to $119/mo. With 100 million active members and another $2 billion in potential revenue awaiting, a $15 million annual increase for TNF streaming rights is just a drop in the bucket.

Amazon also just delivered impressive Q1 ’18 results, posting its most profitable quarter ever. Q1 revenue was up 43% to $35.7 billion, with net income up 121% to $1.6 billion. The company’s cloud computing business (+49% YoY to $5.44 billion), subscription services (think: Amazon Music, +60% YoY to $3.1 billion) and ad revenue (+139% YoY to $2.03 billion) all contributed to the record quarter.

Interested in Sports? Sports Business? Sports Finance? Sign-up for our free daily newsletter

What is JohnWallStreet?

JohnWallStreet, located at the intersection of sports and finance, is a destination for the educated sports fan.

While we won’t be publishing “hot takes” on LeBron’s relative greatness to Jordan, we will be offering up the most relevant sports related business news, in easily digestible bites, with commentary from both the sports money and sports fanatic perspectives.

We’ll cover publicly traded professional teams & stadiums (MSG, RCI, BATRA, MANU), television networks (DIS, FOXA, CMCSA, CBS, TWX, MSGN), apparel & footwear companies (NKE, UAA, ADDYY, FL, LULU), equipment companies (GOLF, ELY, FIT), ticketing companies (EBAY, LYV) content and facilities providers (CHDN, DVD, ISCA,TRK, LMCA). If it trades on Wall Street, and has a sports angle, it’s in our wheel house.

Howie Long-Short and Fan Marino will be providing their expert opinions on each story. They have slightly different areas of expertise. Fan Marino is a firm believer that the SEC is the premier football conference. Howie Long-Short knows it as the Securities & Exchange Commission. Fan Marino lives and dies with the college selection of 5 star, blue chip recruits. Howie Long-Short spends his days analyzing blue chip stocks. Howie Long-Short knows that Black Monday occurred on October 19th, 1987. Fan Marino swears it happens every January after Week 17. You get the point.

Interested in Sports? Sports Business? Sports Finance? Sign-up for our free daily newsletter