Pexels.com

A little over two years ago, I finally admitted to myself that I was in a world of trouble financially.

My marriage was over, I was living alone again, and years of ignoring my snowballing credit card debt was staring me right in the face.

I did three important things that day:

- I cut up all my credit cards. If I couldn’t buy something with cash, I didn’t need it.

- I wrote down all my debt, called a trusted friend who’s good with money and said, “I’m in deep shit. Please help me.”

- I went to the library and picked up several books about getting out of debt.

I haven’t used a credit card in two years. My friend and I game planned on the phone for an hour. I read Total Money Makeover by Dave Ramsey in two days and immediately adopted the envelope system.

Ramsey is a financial guru and radio host who’s been preaching and teaching the envelope system – and his baby step system for getting out of debt – for decades.

After finishing the book, I bought a copy and gifted it to my parents, and suggested the text to several friends and relatives.

The envelope system works. It’s simple. If you’re in debt or just want to save more money each month, I can’t recommend it more.

Here’s how to do it.

Here’s How The Envelope System Works

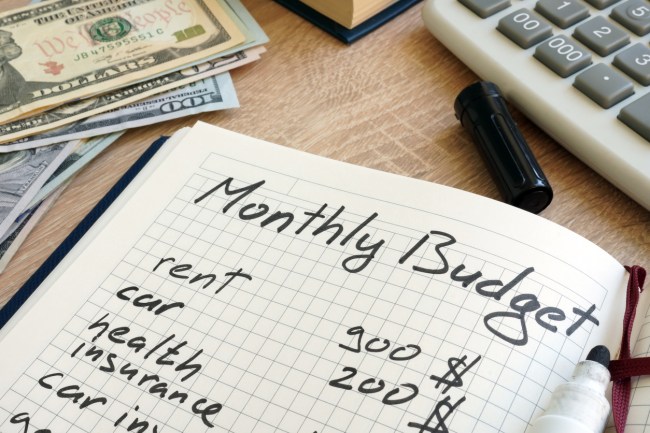

The first step, even before getting envelopes, is sitting down and devising a budget.

Look over your spending in the last few months, come up with an amount of money that will go into each envelope, and write that amount on the envelope.

The next step might involve some paperwork, but it will be well worth the effort.

Find a convenient bank because once a month you’ll have to stop by to withdrawal a large amount of cash.

A branch of my bank is inside my grocery store, so I kill two birds with one stone. I get my money for the month and grocery shop.

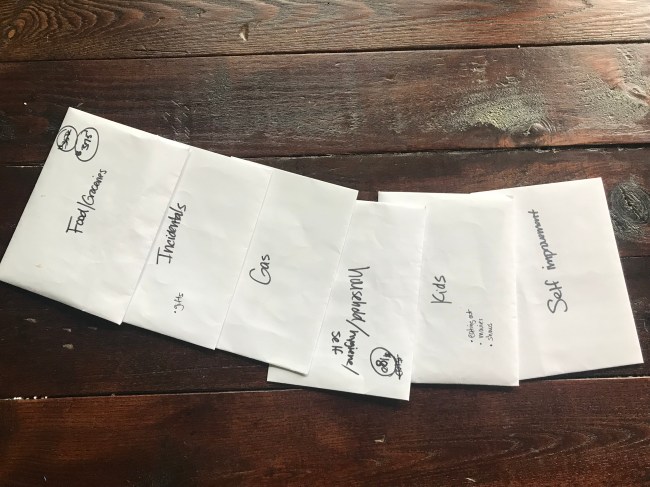

Everyone’s Envelopes Are Different – These Are Mine

Now, let’s talk about the envelope system for saving money and sticking to a budget.

Here are my envelopes, numbered from highest to lowest amounts, and a brief explanation of where the money inside gets spent each month.

via Chris Illuminati

Envelope #1: Groceries and Food

The money in this envelope, obviously, goes to purchasing food. In my case, the cash inside is earmarked for weekly grocery store trips and those rare occasions when I eat out.

I try not to eat out often – maybe once or twice a month – because eating out will kill your budget and waistline.

But sometimes life happens and you’re out and need to get food and didn’t pack any snacks.

This envelope should hold the largest amount of money each month.

Envelope #2: Household / Hygiene

This money is allocated for household supplies like cleaners, laundry needs, soaps, shampoo, body wash, toothpaste, mouthwash, and all the products bought in the same store like Target, Walmart or Costco.

While we’re on the subject, never buy any of these items at a grocery store. I know it’s easier, but you’re getting ripped off.

Envelope #3: Kids (or Entertainment)

I’m a single dad with two kids who stay at my house once every week and every other weekend.

This money is earmarked for kid’s stuff like going to the movies, theme parks, buying toys, books, games and even occasionally food.

If you’re childless, this envelope contains all the money you’re allowed to spend each month on going out and socializing.

In both cases, this envelope should contain the least amount of money.

Envelope #4: Self-Improvement

This envelope is crucial. Every person – even those living paycheck to paycheck – should strive to improve their lives.

Self-improvement means acquiring more skills, being open to more opportunities, and eventually earning more income because of these pursuits.

This envelope is spent on self-improvement items like books, seminars, online classes, hobbies, and even side hustles.

In other words, pay yourself first.

Envelope #5: Gas

Before figuring out just how much money you’ll need each month for gas, go back into your old debit card statements and figure out what you averaged each month on gas.

Now put less than that amount in the envelope.

Why less money?

You should be driving less because you’re not going out to eat at much. Drive less and walk, run, or bike more.

You’ll save money and probably lose a couple pounds.

Personal tip: Make every effort to go to gas stations that aren’t attached to convenience stores. Running in for a quick snack is wasting your money and making you fat.

Envelope #6: Incidentals

These are all the little things that spring up each month that require $10 here and $20 there.

Gifts, tolls, charitable donations, everyone at work throwing in $5 to get Dolores from accounting a gift card because it’s her birthday and any random reason for handing over a couple of bucks.

Essential Things To Remember On The Envelope System

iStockphoto

No “Borrowing”

If there’s a week left, and you’re out of money for food, DON’T BORROW IT from another envelope.

Sorry, you’re shit out of luck. Starve.

Alright, it’s not that drastic, but make a note and either address the amount of money in the envelope or audit where you spent all the cash.

Food is the only time you can take money from another envelope but ONLY this time.

Re-access Each Month

You ran out of food money by the 21st but have $60 still leftover in the gas envelope.

You need to assess your spending at the end of the month.

You either put too much in one envelope, not enough in the other, or you’re just terrible at self-control in specific areas.

Make adjustments, so borrowing doesn’t happen the next month.

Leftovers

It’s the end of the month, and some of the envelopes still have cash inside.

First off, good job, you’re sticking to a budget. Second, take the money out of those envelopes. Don’t leave the money inside and spend it the next month.

My suggestion is to either use the cash to pay down debts – one additional credit card payment a month goes a long way to getting you out of debt – or stick the money in savings and forget about it until a rainy day.

The combination of the baby steps and envelope system helped erased over $6K in debt in the last 18 months, and I’ll use both methods for the rest of my life.

To read more about the envelope system, the baby steps, and Dave Ramsey’s guide to getting out of debt, check out his book Total Money Makeover.

***

Chris Illuminati is a 5-time published author and recovering a**hole who writes about success, fitness, parenting and occasionally pro wrestling. Reach out to him on Instagram & Twitter or email chris@brobible.com.